The new way Wall Street giant Blackstone is trying to reach the investing masses

Wall Street private equity giant Blackstone ( BX ) is teaming up with Vanguard and Wellington Management to get more private assets into the portfolios of everyday savers.

The three money managers on Tuesday said they would jointly develop "multi-asset investment solutions" that offer individual investors exposure to both private and public markets. The hybrid public-private funds would be offered to clients via financial advisers.

The group plans to release more details about those products in the coming months, according to a press release. The Wall Street Journal first reported the alliance on Tuesday.

"Blackstone has been a pioneer in revolutionizing how individual investors access private markets,” Blackstone COO Jon Gray said in a release. "This initiative builds on our proven track record of making institutional-quality investing available to individuals."

Blackstone reports first quarter earnings on Thursday. Its stock fell Wednesday morning. It is down 22% since the beginning of the year amid wider market turmoil.

Blackstone is far from the only asset manager that wants to get more products into the portfolios of Main Street investors.

Big Wall Street private equity giants such as Apollo ( APO ), Partners Group, and KKR ( KKR ) are working with asset managers such as State Street ( STT ), BlackRock ( BLK ), and Capital Group on providing more private funds for Main Street investors. (Disclosure: Yahoo Finance is owned by Apollo Global Management.)

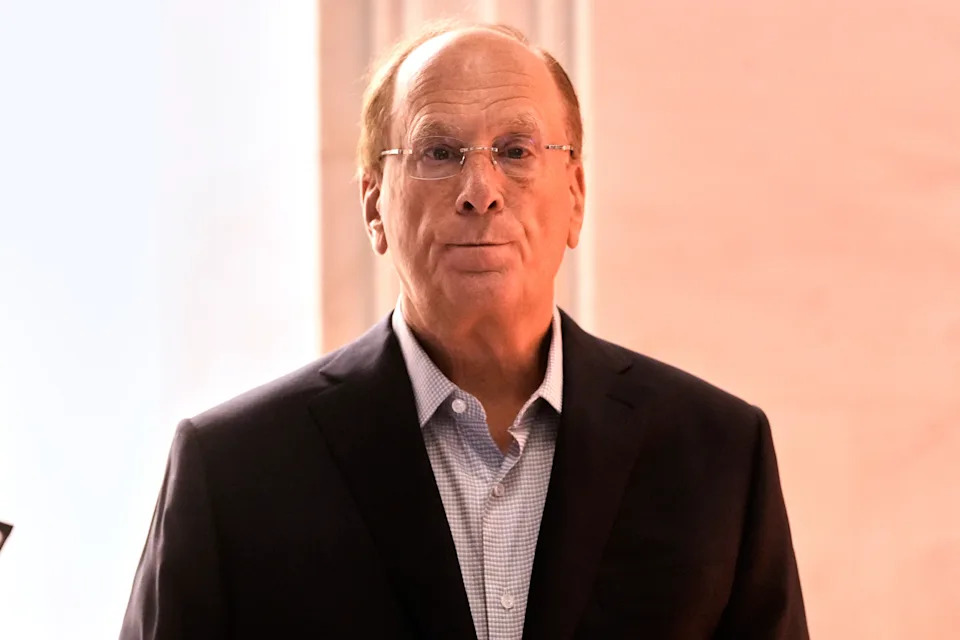

In fact, BlackRock CEO Larry Fink, in his annual management letter , encouraged everyday investors to branch out and diversify into private market assets.

Instead of a traditional 60/40 split between stocks and bonds, he suggested that "the future standard portfolio may look more like 50/30/20 — stocks, bonds, and private assets like real estate, infrastructure, and private credit."

The long-term hope for the private asset world is that the Trump administration will make it easier for them to offer private assets like real estate funds, private loans, and leveraged buyouts of companies to retirement savers through their 401(k)s.

The move would further boost demand for non-listed illiquid bets that aren’t traded on any public exchange. There is more than $12 trillion currently housed in defined-contribution plans that workers rely on for their retirement nest eggs.

The Biden administration didn’t warm up to that idea, but industry watchers are more hopeful that President Trump's second term could open the door for private assets in 401(k)s given that this administration has touted broadly loosening regulations across the financial services world.